A Lot of Fast Moving Parts. A Lot of Studying to do.

Simple story. We love the business concept. Basically we have a niche digital marketing and advertising company, in the multi-billion dollar alcohol business.

Smirnoff alone for example spent $100 million on advertising. Maybe (for now) they can’t attract the likes of a Smirnoff, but there are literally 1000’s of news alcohol brands launched each year, that need a good digital marketer. This could provide years of growth, if they are good at marketing. Or at least good at selling their marketing services, to the start-up brands.

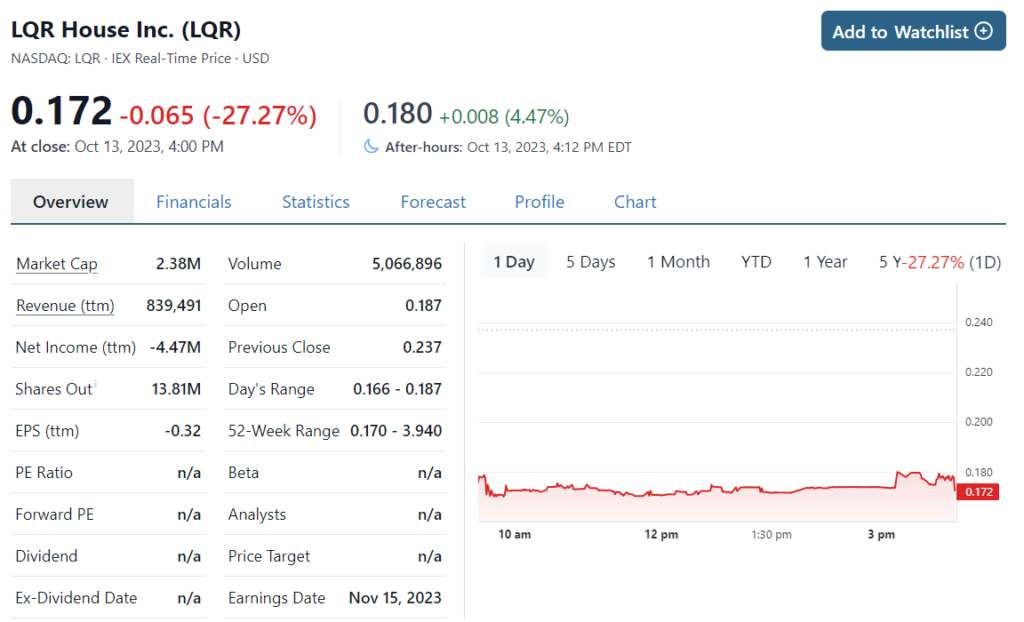

It’s too small, illiquid and volatile for a trade. But it’s down near 95% from it’s IPO in August, so we’re studying it to determine if this could be a $2 or $3.00 stock two or three years from now? The elusive ten-bagger.

We first came across the idea from a hedge fund we know last week, when it was trading at $0.25 and had an incredibly small market market cap near $2.5 million (down from over $50 million at $5.00). So this isn’t for institutions.

They went public at $5.00. Here’s the long-term chart.

LQR House Inc. Announces Closing of $5,750,000 Initial Public Offering

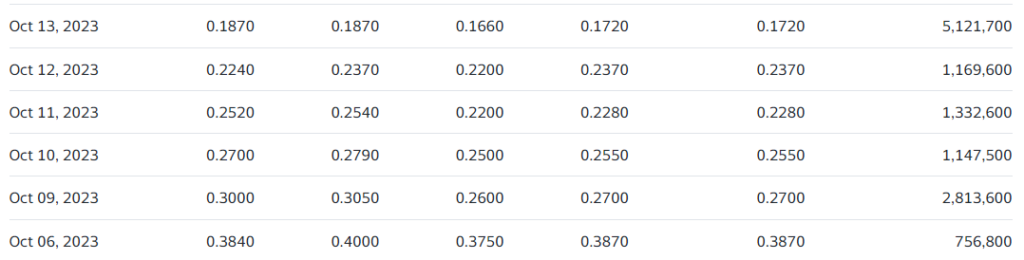

A lot of stocks are performing poorly post-IPO (certainly post secondaries) but this was a eye-opening doozey, so we were interested at $0.25. Then, before we had a chance to read the three-month old prospectus, they raise another $5 million via EF Hutton. This time by selling 28,421,053 shares at $0.19.Wait, what!

LQR House Inc. Announces Pricing of $5.4 Million Public Offering

So we just had to add it to the Watch List at this price!

Assuming it’s a good idea, the strategy here would be to attempt to acquire a meaningful stake, while all the video game type investors are blowing up the volume. These are the guys (and women) who buy at $0.20 to sell at $.0.23 to make a few thousand dollars. Nothing wrong with that, just not our game.

TIME AND SALES

Here’s the offering: Prospectus.

Website: LQR House

One caveat, the balance sheet in the prospectus showed only $100,000 in cash (June 2023). Kinda strange they didn’t have a current balance table displayed, like the day BEFORE the closing.

Anyway, we don’t know if they still have the $5 million from August or if they somehow blew it all. If they still have the $5 million AND they just got another $5 million, then we are highly optimistic about their future.

They had 13 million shares outstanding and then added 29 million, so there would be 42 million shares outstanding, or a market cap of $7 million at $0.17. Hmm.

Read Original Article.