Fintel reports that on January 9, 2024, EF Hutton initiated coverage of LQR House (NasdaqCM:LQR) with a Buy recommendation.

Analyst Price Forecast Suggests 7,848.05% Upside

As of December 16, 2023, the average one-year price target for LQR House is 306.00. The forecasts range from a low of 303.00 to a high of $315.00. The average price target represents an increase of 7,848.05% from its latest reported closing price of 3.85.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for LQR House is 36MM, an increase of 3,972.42%. The projected annual non-GAAP EPS is -64.84.

What are Other Shareholders Doing?

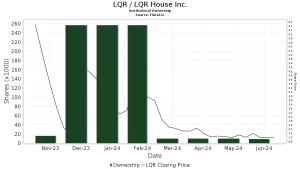

Virtu Financial holds 105K shares representing 3.66% ownership of the company.

Citadel Advisors holds 70K shares representing 2.44% ownership of the company.

Hrt Financial holds 36K shares representing 1.27% ownership of the company.

Commonwealth Equity Services holds 17K shares representing 0.58% ownership of the company.

UBS Group holds 16K shares representing 0.55% ownership of the company.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Read Original Article.