A Quick Take On LQR House Inc.

LQR House Inc. (LQR) has filed to raise $5 million in an IPO of its common stock, according to an S-1 registration statement.

The firm provides digital marketing and brand development for alcoholic beverages in the United States.

Due to the company’s tiny size, operating losses, thin capitalization and excessive valuation assumptions, my outlook on the IPO is Sell.

LQR House Overview

Miami Beach-based LQR House Inc. was founded to develop capabilities to market alcoholic beverages online for its in-house and emerging brands.

Management is headed by founder and CEO Sean Dollinger, who has been with the firm since its inception in 2021 and was previously founder of PlantX Life and founder, president and CEO of Lifeist Wellness.

The company has a partnership with Country Wine & Spirits, holding the “rights for all marketing elements for CWS allowing significant support for emerging brands, whilst their exclusive influencer network serves as affiliates for LQR House directing traffic to www.cwspirits.com.”

As of March 31, 2023, LQR House has booked fair market value investment of $5.8 million from investors including KBROS, Joel Abbo, Index Equity US LLC, Kiranjit Sidhu and 2200049 AB Inc.

LQR House – Customer Acquisition

The firm intends to focus initially on tequila, wine and other specialty products in the U.S.

Management acquired the trademark to SWOL to market various types of SWOL tequila imported into the U.S.

Sales and marketing expenses as a percentage of total revenue have dropped as revenues have increased from a tiny base, as the figures below indicate:

| Sales and Marketing | Expenses vs. Revenue |

| Period | Percentage |

| Three Mos. Ended March 31, 2023 | 32.1% |

| 2022 | 109.0% |

| Jan. 11, 2021 to Dec. 31, 2021 | 147.2% |

(Source – SEC)

The sales and marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of sales and marketing expense, rose to 2.5x in the most recent reporting period, as shown in the table below:

| Sales and Marketing | Efficiency Rate |

| Period | Multiple |

| Three Mos. Ended March 31, 2023 | 2.5 |

| 2022 | 0.4 |

(Source – SEC)

LQR House’s Market and Competition

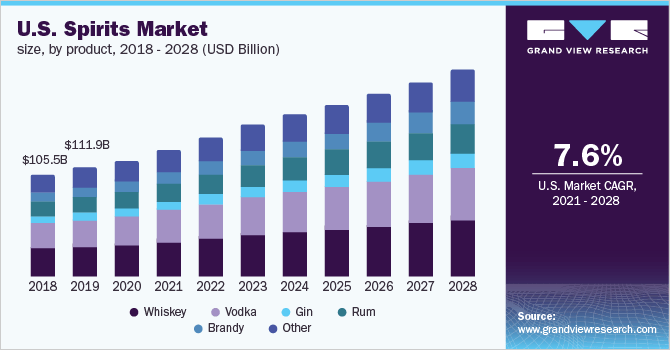

According to a recent market research report by Grand View Research, the North American market for spirits was an estimated $154 billion in 2020 and is forecast to reach nearly $279 billion by 2028.

This represents a forecast CAGR of 7.7% from 2021 to 2028.

The main drivers for this expected growth are an increase in demand for premium quality products with unique flavors and distinct tastes.

Also, the chart below shows the historical and projected future growth of the U.S. spirits market:

U.S. Spirits Market (Grand View Research)

Major competitive or other industry participants include all manner of alcoholic beverage companies and marketing firms.

LQR House Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

- Growing topline revenue from a tiny base

- Positive gross profit and gross margin

- Reduced operating loss

- Lowered cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

| Total Revenue | ||

| Period | Total Revenue | % Variance vs. Prior |

| Three Mos. Ended March 31, 2023 | $ 150,563 | 433.0% |

| 2022 | $ 601,131 | 90.7% |

| Jan. 11, 2021 to Dec. 31, 2021 | $ 315,292 | |

| Gross Profit (Loss) | ||

| Period | Gross Profit (Loss) | % Variance vs. Prior |

| Three Mos. Ended March 31, 2023 | $ 47,566 | -116.7% |

| 2022 | $ (202,013) | -44.2% |

| Jan. 11, 2021 to Dec. 31, 2021 | $ (362,155) | |

| Gross Margin | ||

| Period | Gross Margin | % Variance vs. Prior |

| Three Mos. Ended March 31, 2023 | 31.59% | 1039.4% |

| 2022 | -33.61% | -70.7% |

| Jan. 11, 2021 to Dec. 31, 2021 | -114.86% | |

| Operating Profit (Loss) | ||

| Period | Operating Profit (Loss) | Operating Margin |

| Three Mos. Ended March 31, 2023 | $ (322,074) | -213.9% |

| 2022 | $ (1,842,175) | -306.5% |

| Jan. 11, 2021 to Dec. 31, 2021 | $ (1,962,726) | -622.5% |

| Net Income (Loss) | ||

| Period | Net Income (Loss) | Net Margin |

| Three Mos. Ended March 31, 2023 | $ (322,074) | -213.9% |

| 2022 | $ (1,842,175) | -1223.5% |

| Jan. 11, 2021 to Dec. 31, 2021 | $ (1,962,726) | -1303.6% |

| Cash Flow From Operations | ||

| Period | Cash Flow From Operations | |

| Three Mos. Ended March 31, 2023 | $ (233,433) | |

| 2022 | $ (918,197) | |

| Jan. 11, 2021 to Dec. 31, 2021 | $ (1,479,014) | |

| (Glossary Of Terms) |

(Source – SEC)

As of March 31, 2023, LQR House had $23,581 in cash and $432,537 in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was ($534,602).

LQR House Inc. IPO Details

LQR House intends to raise $5 million in gross proceeds from an IPO of its common stock, offering one million shares at a proposed midpoint price of $5.00.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company also is registering for sale approximately 5.4 million shares of common stock to be sold by selling shareholders. If these additional shares are sold by selling shareholders in a short period of time post IPO, the effect on the company’s stock price could be significantly negative.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $50.5 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 8.96%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

The firm is an “emerging growth company” as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements. Prospective shareholders would receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

Management says it will use the net proceeds from the IPO as follows:

66.7% of the net proceeds (approximately $2,638,645, or approximately $3,093,872 if the underwriters exercise the over-allotment option in full) for acquisitions of alcoholic beverage brands;

20% of the net proceeds (approximately $791,198, or approximately $927,698 if the underwriters exercise the over-allotment option in full) to invest in marketing of existing brands, including SWOL;

10% of the net proceeds (approximately $395,599, or approximately $463,849 if the underwriters exercise the over-allotment option in full) for working capital and general corporate purposes; and

3.3% of the net proceeds (approximately $130,547, or approximately $153,070 if the underwriters exercise the over-allotment option in full) to compensate certain executive officers.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says it is not aware of any legal claims that would have a material adverse effect on its financial condition or business.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For LQR House

Below is a table of relevant capitalization and valuation figures for the company:

| Measure [TTM] | Amount |

| Market Capitalization at IPO | $55,777,170 |

| Enterprise Value | $50,528,089 |

| Price / Sales | 77.10 |

| EV / Revenue | 69.84 |

| EV / EBITDA | -34.53 |

| Earnings Per Share | -$0.13 |

| Operating Margin | -202.24% |

| Net Margin | -202.24% |

| Float To Outstanding Shares Ratio | 8.96% |

| Proposed IPO Midpoint Price per Share | $5.00 |

| Net Free Cash Flow | -$534,602 |

| Free Cash Flow Yield Per Share | -0.96% |

| Revenue Growth Rate | 432.97% |

| (Glossary Of Terms) |

(Source – SEC)

Commentary About LQR House’s IPO

LQR is seeking U.S. public capital market investment to acquire additional alcoholic brands and for its general corporate purposes.

The company’s financials have produced increasing topline revenue from a tiny base, gross profit and gross margin, lowered operating loss and reduced cash used in operations.

Free cash flow for the twelve months ending March 31, 2023, was ($534,602).

Sales and marketing expenses as a percentage of total revenue has fallen as revenue has grown. Its sales and marketing efficiency multiple rose to 2.5x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the firm’s growth and working capital requirements.

LQR’s recent financial history indicates it hasn’t spent on capital expenditures at all as a percentage of its operating cash flow.

The market opportunity for selling spirits in North America is large and likely to grow at a moderate pace going forward.

EF Hutton is the sole underwriter, and the 15 IPOs led by the firm over the last 12-month period have generated an average return of negative (60.0%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its tiny size against larger competitors, its thin capitalization and lack of a successful track record.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 69.8x.

Due to the company’s tiny size, operating losses, thin capitalization and excessive valuation assumptions, my outlook on the IPO is Sell.

Read Original Article.